BTC Price Prediction: Navigating Volatility with Cautious Optimism

#BTC

- Technical Consolidation: BTC shows signs of basing near support levels with improving momentum indicators

- Regulatory Balance: Increased scrutiny countered by growing institutional adoption and ETF inflows

- Market Positioning: Current levels may offer entry points for long-term investors despite short-term uncertainty

BTC Price Prediction

BTC Technical Analysis: Consolidation Phase with Bullish Potential

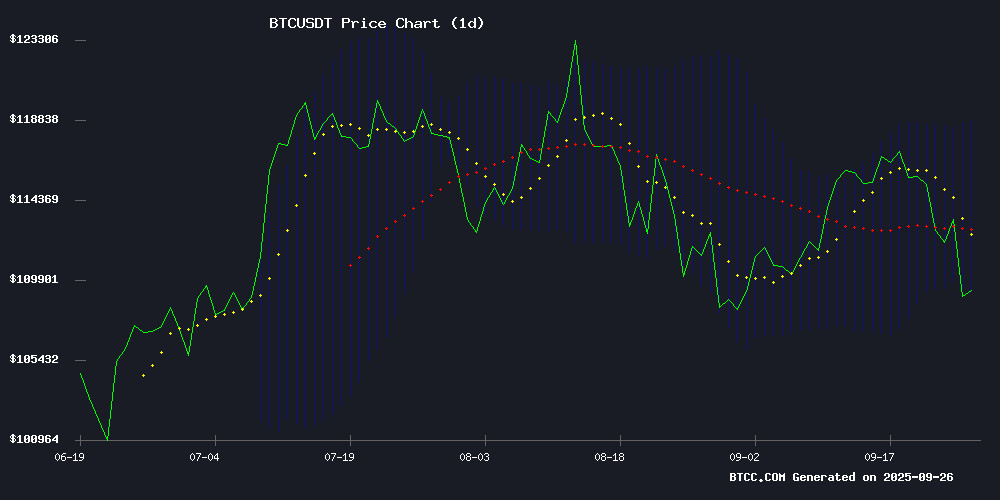

BTC is currently trading at $109,662, below its 20-day moving average of $114,011, indicating short-term bearish pressure. However, the MACD shows promising signs with the histogram at 1,379.4273, suggesting weakening downward momentum. The price sits NEAR the lower Bollinger Band at $109,283, which often acts as a support level. According to BTCC financial analyst Sophia, 'The technical setup suggests BTC is in a consolidation phase. A break above the 20-day MA could trigger a move toward the upper Bollinger Band at $118,740.'

Regulatory Headwinds Offset by Institutional Adoption

Market sentiment remains mixed as regulatory scrutiny intensifies with SEC and FINRA probing over 200 corporate crypto treasury firms. However, institutional adoption continues with Vanguard exploring crypto ETF access and BlackRock monetizing Bitcoin holdings. BTCC financial analyst Sophia notes, 'While regulatory uncertainty creates short-term volatility, the entry of traditional finance giants signals long-term legitimacy. ETF inflows provide steady demand despite Fed caution.'

Factors Influencing BTC's Price

Vanguard Explores Crypto ETF Access in Strategic Pivot

Vanguard, the $10.1 trillion asset management giant, is reconsidering its cautious stance on cryptocurrencies. The firm is reportedly developing plans to offer crypto ETF access to US clients—a move that could funnel tens of billions into digital assets. This follows BlackRock's successful capture of nearly $90 billion in Bitcoin ETF flows, demonstrating institutional demand.

The shift marks a watershed moment for crypto adoption. As two of the world's largest asset managers now engage with digital assets, market structure appears poised for transformation. Bitcoin remains the primary beneficiary, though the decision may catalyze broader altcoin acceptance.

BlackRock Moves to Monetize Bitcoin Holdings Through Premium Income ETF

Asset management giant BlackRock is expanding its cryptocurrency offerings with a new Delaware trust company linked to its proposed Bitcoin Premium Income ETF. The filing signals strategic intent to diversify beyond its wildly successful iShares Bitcoin Trust (IBIT), which has dominated institutional crypto inflows.

The move underscores Wall Street's accelerating adoption of Bitcoin as an asset class. By creating yield-generating vehicles, traditional finance players are building infrastructure to hold digital assets on balance sheets while satisfying investor demand for cash flow.

200+ Corporate Crypto Treasury Firms Under Probe from SEC, FINRA

U.S. regulators are intensifying scrutiny on corporate crypto treasuries, with the SEC and FINRA investigating over 200 companies holding cryptocurrency reserves. Unusual stock activity, including sharp price jumps and high trading volumes before major crypto purchase announcements, has raised suspicions of insider trading. Violations of the Fair Disclosure Rule (Reg FD) are a key focus, as selective sharing of market-moving data is strictly prohibited.

Corporate adoption of Bitcoin continues to surge, with 194 public companies now holding more than 1 million BTC—worth over $110 billion and representing 4.6% of Bitcoin's total supply. Michael Saylor's Strategy leads the pack with 639,835 BTC (~$70B), followed by Marathon Digital and Twenty One Capital. Strategy recently acquired 850 BTC for ~$99.7 million at ~$117,344 per Bitcoin, achieving a 26.0% YTD BTC yield through 2025.

Bitcoin's Fragile Recovery Amid Fed Caution and Steady ETF Inflows

Bitcoin's brief rebound faltered as Federal Reserve Chair Jerome Powell tempered expectations for aggressive rate cuts, framing the recent quarter-point reduction as a risk management measure rather than the start of an easing cycle. Inflation remains the central bank's primary focus, with Powell emphasizing data-dependent decisions—a stance that injected fresh uncertainty into crypto markets.

Meanwhile, Wall Street's spot Bitcoin ETFs continue to absorb capital quietly, with $241 million flowing into these products mid-week. BlackRock's iShares fund led the pack, underscoring institutional interest despite macroeconomic headwinds. Historical trends suggest the fourth quarter could still deliver strong Bitcoin performance, but the Fed's cautious rhetoric casts a shadow over these expectations.

SEC and FINRA Probe Suspected Insider Trading at Digital Asset Treasury Firms

U.S. regulators are intensifying scrutiny of digital asset treasury firms following unusual trading patterns that suggest potential insider dealing. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are jointly investigating whether certain firms or individuals profited from nonpublic information related to corporate cryptocurrency acquisitions.

Suspicious trading activity, including abnormal volume and price spikes preceding major Bitcoin or digital asset purchase announcements, has raised red flags. Venture capitalist Mike Dudas characterized the situation as "a brewing bloodbath," arguing that such enforcement actions are necessary to restore confidence in the digital asset markets.

While no firms have been named publicly, regulators emphasize the importance of simultaneous disclosure of market-moving decisions. The probe comes as corporate treasuries increasingly allocate to cryptocurrencies, putting pressure on watchdogs to demonstrate rigorous oversight.

Jim Cramer Warns American Bitcoin (ABTC) Investors of High Risk Amid Market Volatility

CNBC's Jim Cramer has issued a stark warning about American Bitcoin (ABTC), the mining firm linked to Eric Trump and backed by Hut 8. On his Mad Money Lightning Round, Cramer labeled ABTC as "pure speculation," cautioning investors that the stock could lose all its value. The comments followed a 4.29% drop in ABTC shares, closing at $6.69 amid a broader crypto market pullback.

ABTC began trading on Nasdaq in early September after merging with Gryphon Digital Mining. The company, majority-owned by Hut 8, positions itself as a cornerstone of U.S. Bitcoin mining infrastructure. Eric Trump has championed the venture, adding a political dimension to its narrative. Cramer's remarks underscore the high-risk, high-reward nature of crypto-related equities in the current market climate.

Egorov's Yield Basis Protocol Aims to Eliminate Impermanent Loss in DeFi

Michael Egorov, founder of Curve Finance, has launched Yield Basis—a decentralized protocol designed to tackle impermanent loss, a longstanding pain point for Bitcoin and crypto liquidity providers. The innovation rethinks automated market maker (AMM) mechanics to create a safer yield environment.

Traditional DeFi lending pools offer meager 1-2% annual returns for BTC holders while exposing them to capital erosion risks. Yield Basis' restructured AMM model claims to remove this friction, potentially unlocking greater institutional participation and liquidity across decentralized networks.

The protocol arrives as Bitcoin's market cap approaches $110,000, with investors increasingly demanding sophisticated yield instruments that don't compromise principal protection. Egorov's solution could redefine risk-reward parameters for yield farming.

$1.15B FTX Lawsuit Exposes Broken Trust While MAGAX Presale Offers a Transparent Alternative

The fallout from FTX's collapse continues to reverberate through crypto markets. A $1.15 billion lawsuit filed by the FTX Recovery Trust against a Bitcoin mining firm alleges billions in customer funds were funneled through Alameda Research to Genesis Capital. Court documents claim over half these funds went directly to Genesis co-founders, leaving retail investors empty-handed.

The case underscores systemic issues plaguing crypto ventures: inflated valuations, lax oversight, and preferential treatment for insiders. Genesis reportedly executed deals without proper audits, enabling early stakeholders to profit while late-coming retail traders bore the brunt of losses. Such patterns have eroded market confidence, creating demand for projects with verifiable fundamentals.

Emerging projects like MAGAX aim to rewrite this narrative through transparent presales and measurable utility. Unlike ventures reliant on hype cycles, its structured offering provides clear entry points backed by demonstrable ecosystem development—a contrast to the opaque dealings now facing legal scrutiny.

Spot Crypto ETFs Pose Competitive Threat to Treasury Firms Amid Regulatory Scrutiny

The rise of spot cryptocurrency ETFs is reshaping market dynamics, creating headwinds for companies specializing in crypto treasury management. Nate Geraci, a prominent ETF analyst, warns that firms like MicroStrategy (MSTR), Metaplanet (MTPLF), and BitMine (BMNR) face existential challenges as SEC-approved ETFs eliminate their regulatory arbitrage advantages.

Regulatory bodies have intensified surveillance, with the SEC and FINRA investigating unusual trading patterns around treasury firms' Bitcoin acquisition announcements. These probes frequently escalate into full-scale insider trading inquiries, according to Wall Street Journal sources.

Market structure is evolving rapidly. Where treasury companies once dominated institutional crypto exposure, spot ETFs now offer superior liquidity and transparency. Geraci observes this transition marks a fundamental shift in how investors access digital asset exposure—through regulated vehicles rather than corporate balance sheets.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a nuanced investment case. The technical indicators show consolidation with bullish potential, while regulatory developments create short-term uncertainty.

| Metric | Current Value | Implication |

|---|---|---|

| Price vs 20-day MA | -3.8% below | Short-term bearish |

| MACD Histogram | +1,379.43 | Momentum improving |

| Bollinger Position | Near lower band | Potential support |

| Regulatory Climate | Mixed | Increased scrutiny |

| Institutional Flow | Positive | ETF adoption growing |

As BTCC financial analyst Sophia emphasizes, 'Investors should consider dollar-cost averaging and maintain a long-term perspective given BTC's historical resilience amid volatility.'